how long can you go without paying property taxes in missouri

If the auctioned property is a homestead--meaning it was the primary place of residence for the owner--the owner can buy back his tax deed within two years from the date of the auction. Another example of when you may want to pay someone elses taxes is if you inherited a property and the property is going through probate which can be a long process in some states.

Individual Income Tax Electronic Filing

Five years In California you generally have five years to get current on delinquent property taxes.

. Vacant lots with petitioned specials are eligible for tax foreclosure sale after real estate taxes remain unpaid for 2 ½ years. If you dont pay your California property taxes you could eventually lose your home through a tax sale. So you get at least this long to pay off the tax debt and save your property.

In Wisconsin most people get a two-year redemption period to pay off all taxes penalties interest and other costs called redeeming the home before the county can start the process to get title to the property. An acknowledgment is issued when your return is received and accepted. To find New Jerseys laws that discuss property tax lien sales go to Title 54 545-1 through 545-137 of the New Jersey Statutes.

Under Missouri law when you dont pay your property taxes the county collector is permitted to sell your home at a tax sale to pay the overdue taxes interest and other charges. In this case the new delinquency date would be March 1. A tax sale must happen within three years though state law permits an earlier sale if the taxes are delinquent.

You can have your refund direct deposited into your bank account. Counties in mississippi collect an average of 052 of a propertys assesed fair market value as property tax per year. When a home sells at a third tax sale you get 90 days to redeem the property.

In Missouri a tax sale will typically take place if you dont pay the property taxes on your home for three years. Your taxes can remain unpaid for a maximum of five years following their tax default at which time your property becomes subject to the power of sale. How long can you go without paying property taxes in New Mexico.

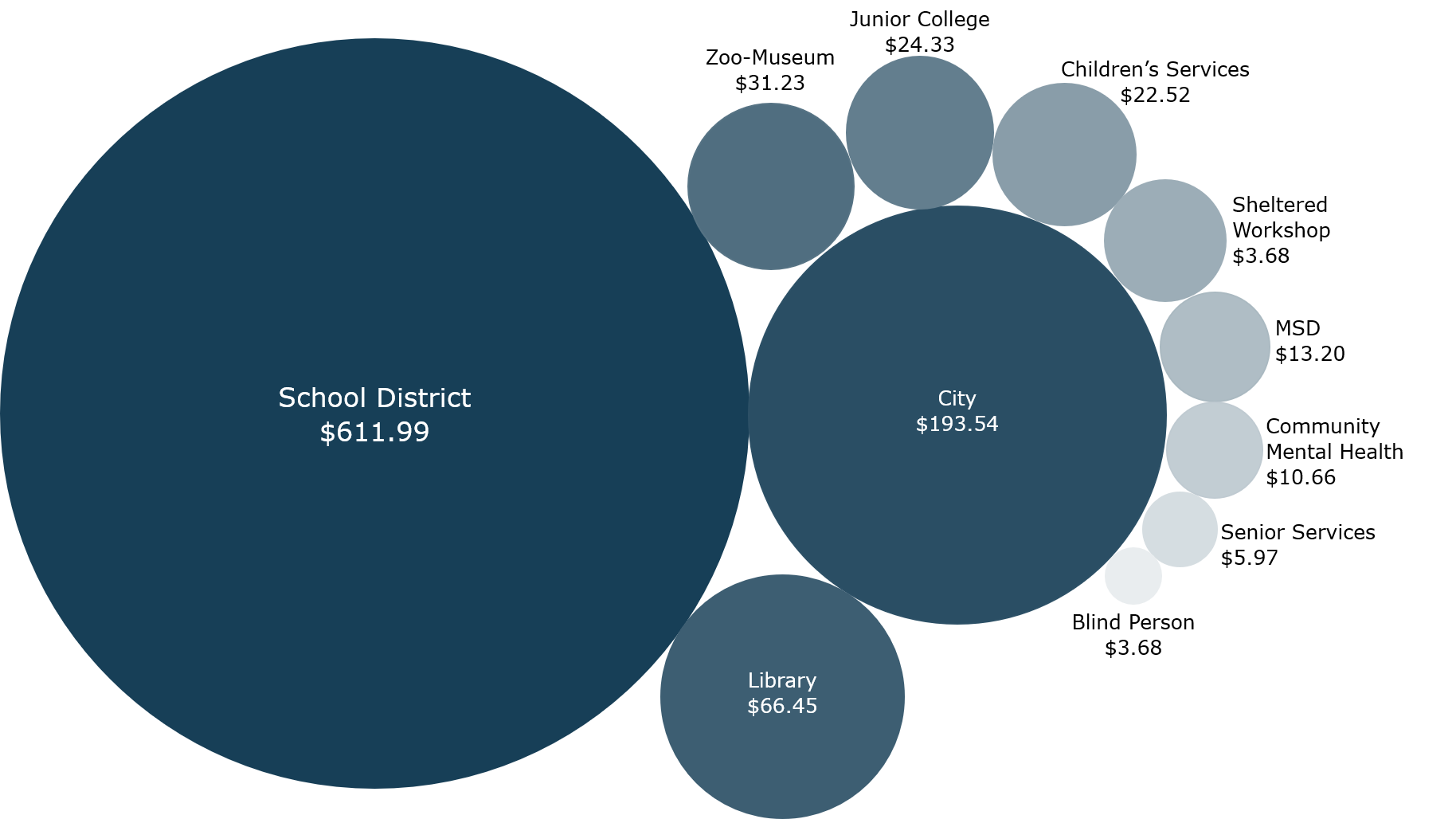

As for property taxes the homeowner forfeits the property to the agency in the second year of a tax delinquency. Missouri Property Tax Rates The states average effective property tax rate is 093 somewhat lower than the national average of 107. You can always mail your tax payment or go into the tax assessors thereafter taxes are due annually as long as you own the property.

In Michigan state law allows any public taxing agency -- state or local -- to claim a lien on property once 35 days have passed after a final bill is sent to the homeowner. No Right to Redeem After a Subsequent Sale If no one buys the property at the first second or third tax sale but it does sell at a subsequent offering you dont get a redemption period. If the property is not a homestead property however the original owner must buy back the deed and pay full penalties within six months.

This three-year period is called a redemption period. Some states allow the property tax authority to foreclose on the home directly if taxes go unpaid. 415 50 Views.

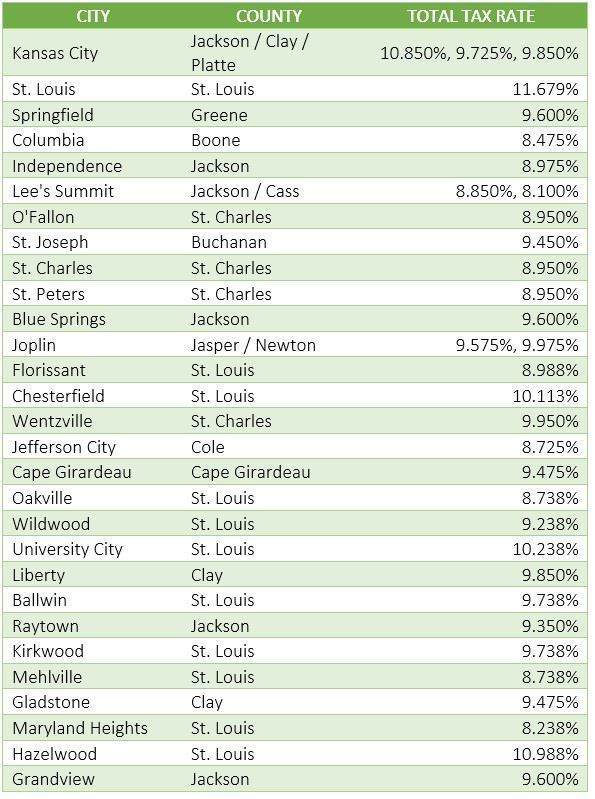

Consider these five ways to avoid spiking into a higher tax rentals. How long can you go without paying property taxes in Nebraska. Rates in Missouri vary significantly depending on where you live though.

What Happens Once You Fall Behind on Your Property Taxes. No 95 Feb 16 1966 concluding that non-resident military personnel stationed in Missouri may obtain a certificate of no tax due often called a waiver from the collector and license their cars in Missouri without paying property tax on them. For property sold in the 2019-20 tax year youll have until the next self-assessment tax deadline on 31 January 2021 to declare any profit made from the sale and pay the tax owed.

How long can you go without paying property taxes in California. Federal estate tax An estate could subject to the federal estate tax if its more than 1158 million. Statutes change so checking them is always a good idea.

Due dates for inheritance taxes vary by state. Pittsburgh age discrimination lawyer. How Long You Get to Redeem Your Property After a Nebraska Tax Sale.

Other real estate parcels are eligible for tax foreclosure sale after taxes remain unpaid for. It turns out that you can avoid paying taxes if you understand some of the ins and outs of the tax code. Otherwise you could lose your home in a tax sale.

In Montana if a property owner doesnt pay their taxes over a long enough period of time the deed can be transferred to a third-party tax sale purchaser often for pennies on the dollar. If your tax bill is not mailed out until after January 10 your delinquency date will get pushed out. What is a personal property tax waiver.

How long can you go without paying property taxes in SC. A tax waiver also known as Statement of Non-Assessment indicates a specific person business or corporation does not owe any personal property taxes for a specified tax year. For instance if the bill goes out on January 20 you wont get that 21-day window to pay by the 31st.

For example you could inherit property from an heir in one of the six states that do impose an inheritance tax like Kentucky. Paying Online The Missouri Department of Revenue accepts online payments including extension and estimated tax payments using a credit card or E-Check Electronic Bank Draft. How long can you go without paying property taxes in California.

At the sale the winning bidder bids on the property and gets a. Then youd need to pay that inheritance tax. Wait too long and the recalcitrant property owner may find the.

The purchaser must wait until three years expires before taking the necessary steps to obtain ownership of your home. 140150 140190. How long can property taxes go unpaid in Kansas.

Under South Carolina law you get a specific amount of time called a redemption period to pay off the tax debt called redeeming the property after the sale before the winning bidder from the auction gets title to your home. 45 Votes In Missouri a tax sale will typically take place if you dont pay the property taxes on your home for three years. If a property is delinquent for 3 years it is placed on a Delinquency List that is sent to the State of New Mexico Property Tax Division in July of each year.

But under state law it could take place sooner. How long can you go without paying property taxes in Wisconsin.

Pay Property Taxes Online Jackson County Mo

Missouri Estate Tax Everything You Need To Know Smartasset

Personal Property Tax Jackson County Mo

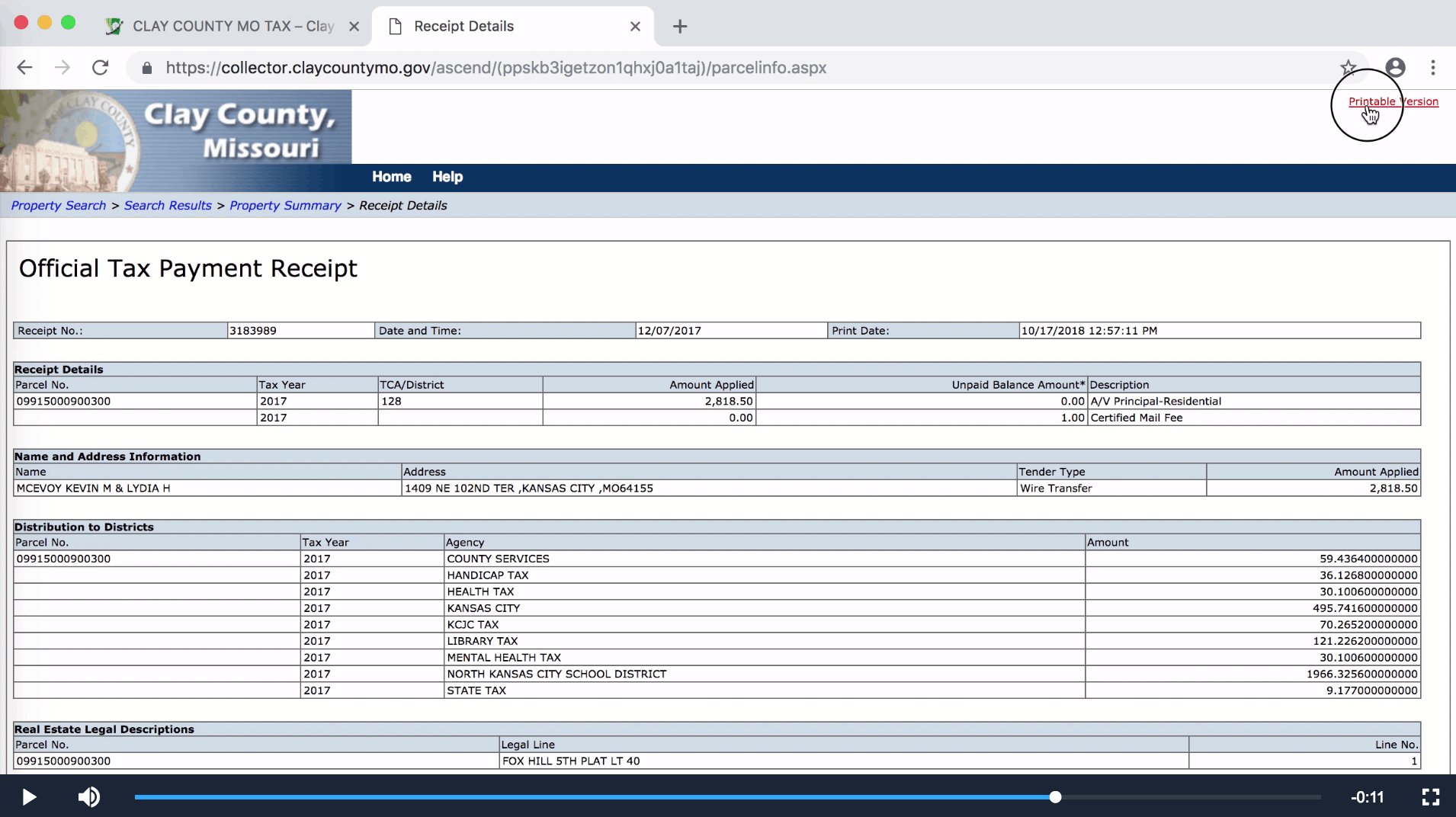

Download Print Tax Receipt Clay County Missouri Tax

Missouri Tax Forms 2021 Printable State Mo 1040 Form And Mo 1040 Instructions

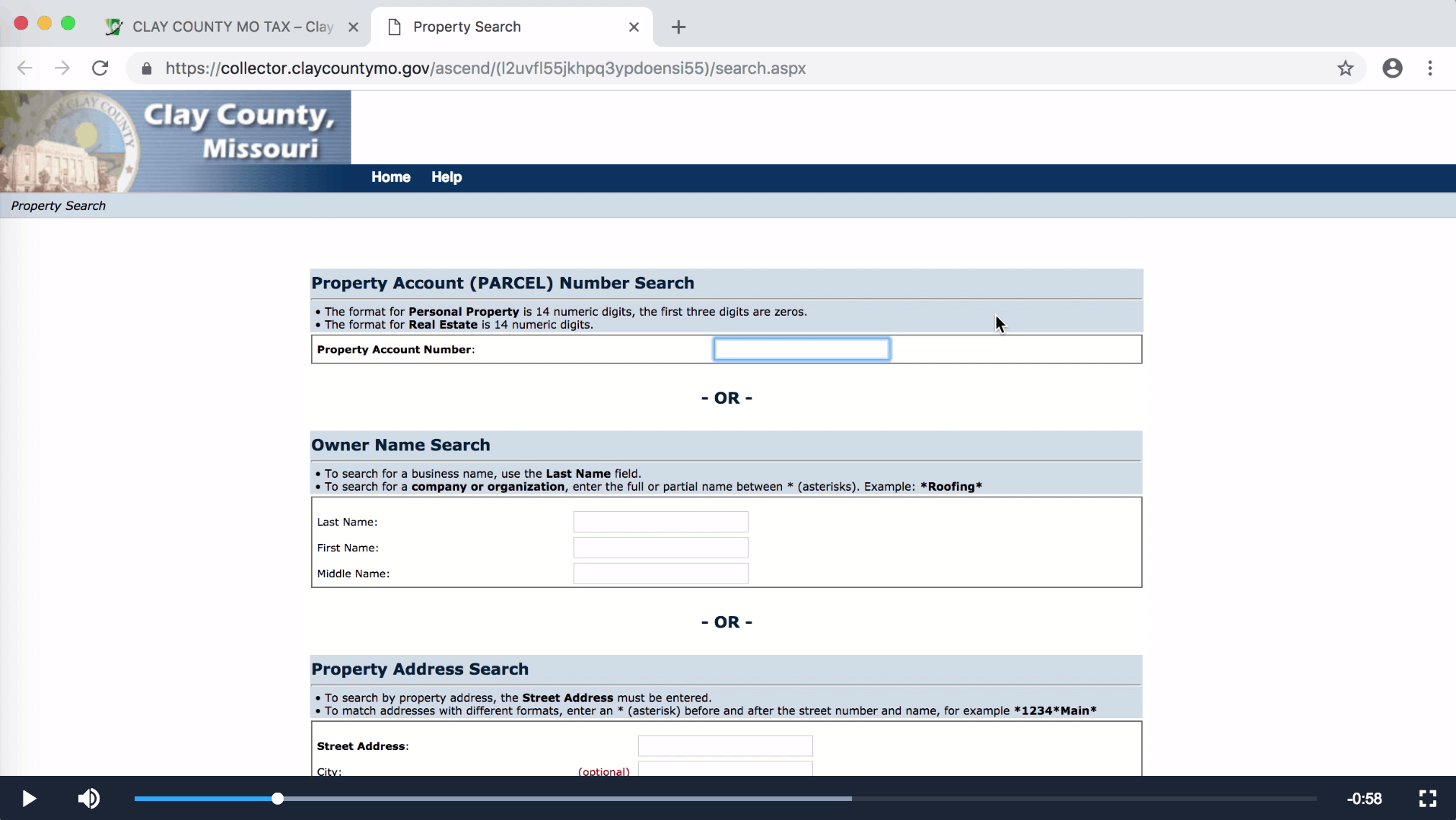

Pay Your Bill Online Clay County Missouri Tax

How To Get A Sales Tax Exemption Certificate In Missouri Startingyourbusiness Com

Missouri Income Tax Rate And Brackets H R Block

Temp Tags New Missouri Vehicle Sales Tax Law Takes Effect In August Fox 2

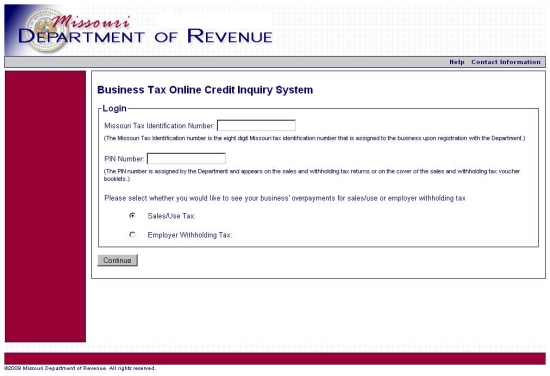

Sales Use Tax Credit Inquiry Instructions

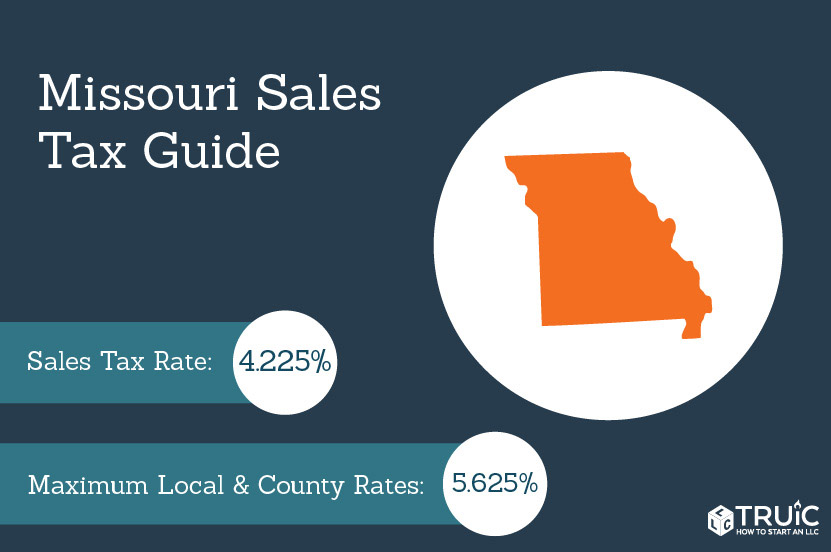

Missouri Sales Tax Small Business Guide Truic

Missouri Estate Tax Everything You Need To Know Smartasset

Property Tax City Of Raymore Mo